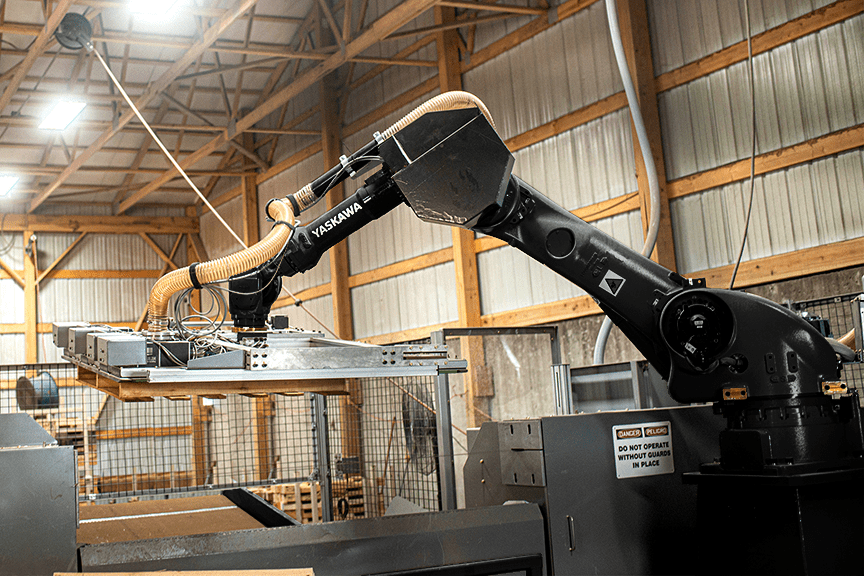

Financing

Teaming up with financial companies to provide industry leading equipment financing

Advantages of Leasing & Financing:

- Total project financing, including all soft costs

- Preserve cash and existing credit lines

- Fixed, predictable payments protect against inflation

- Conserve working capital

- Flexible End of Term options

- Avoid technological obsolescence

- Potential tax benefits

Leasing & Financing Facts:

Our service commitment goes beyond just providing financing for your machinery. Before you place your order, your personal finance manager will explain all options and benefits in easy to understand terms. Start-to-finish, you will have a dedicated professional making the process simple and transparent.

Trusted Finance Partners

Frequently Asked Questions:

Leasing and financing offers many advantages over other types of payments, including saving cash as well as having 100% financing unlike a bank loan that will usually require a 20%+ down payment. There may also be tax benefits that will save you money. Leasing and financing allows most businesses the opportunity to acquire revenue generating equipment and match its cash inflows and outflows, essentially letting the equipment pay for itself while still generating a positive cash flow for the business.

For transactions up to $500,000, only a one page application is required. For transactions over $500,000, two-years of company financials and current interims often satisfy our credit review.

For most transactions up to $500,000, you will receive a credit decision within one business hour, dependent upon the accuracy of the information provided.

All new and pre-owned equipment, software, installation charges, delivery charges, tooling and training can be included in your lease or financing. Peripheral equipment can also be included (i.e. dust collection systems).

Leasing or financing can provide a more rapid write-off because the lease term is often shorter than the depreciable life of the equipment, and the monthly payments are often 100% tax deductible as a pre-tax business expense. Consult your tax advisor for specific information. For the most up-to-date information, go to www.irs.gov.

Section 179 of the IRS tax code currently allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

*Note that Summit Funding Group, Inc. cannot provide specific financial, accounting or legal advice.

For more information contact our financing specialist:

Dervla Erin O’Neill

(630) 596-5356

EOneill@engsfinance.com

About ENGS Commercial Finance

ENGS Commercial Finance Co., a Mitsubishi UFJ Lease and Finance company, is one of the most well-respected independent finance companies with 65 years of experience in the Manufacturing and Industrial markets. This tenured experience enables us to provide our customers with industry-specialized finance programs, competitive pricing and the highest level of service and finance tools in the market. Rest assured, we have the most competitive lease and loan products in the industry to help you grow your business.

JOIN THE ALLIANCE

REQUEST A QUOTE

Are you looking to automate your processes within your organization? Get a custom quote today to see what we can do for your business.

"*" indicates required fields